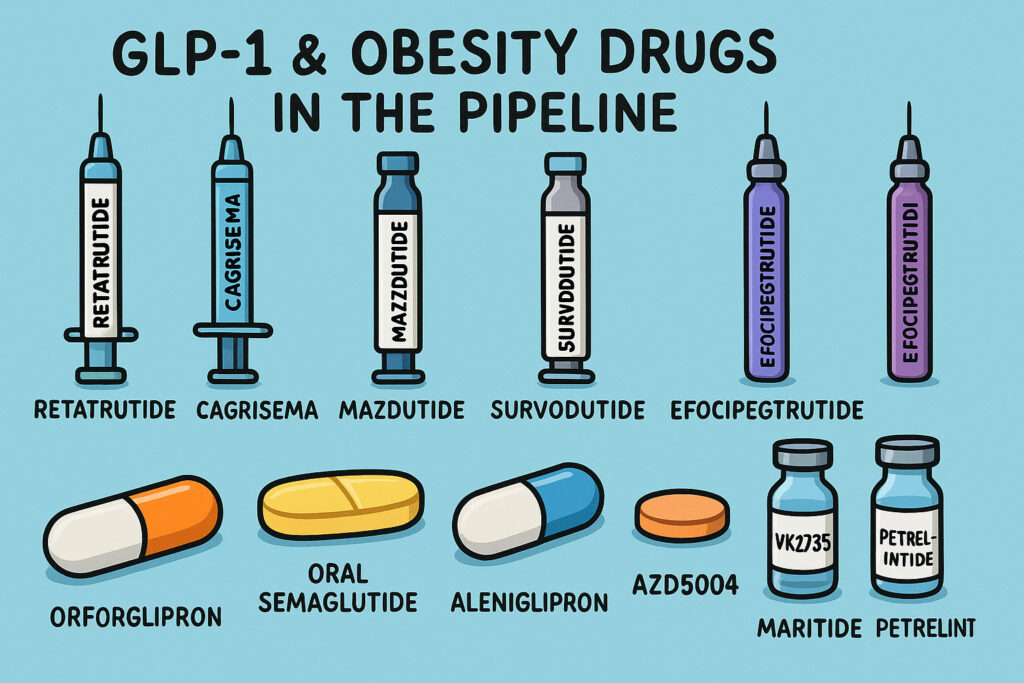

Pipeline drugs

| Drug | Type | Key Milestones |

|---|---|---|

| CagriSema | Injectable dual | FDA/EMA filing – 2026 |

| Retatrutide | Injectable triple | Phase III – 2026–2027 |

| Mazdutide | Injectable dual | China approved June 2025; global trials in 2026 |

| Survodutide | Injectable dual | Phase III – 2027 |

| Orforglipron | Oral GLP‑1 | FDA filing late 2025; launch 2026 |

| Oral semaglutide | Oral GLP‑1 | FDA approval Q4 2025 |

| Aleniglipron | Oral GLP‑1 | Phase II – 2025+ |

| AZD5004 | Oral GLP‑1 | Phase II – 2025+ |

| VK2735 | Dual agonist, oral/ivj | Late‑stage trials mid‑2025 |

| MariTide | Monthly injectable | Phase III ongoing |

| Petrelintide & ACCG‑2671 | Amylin class | Early‑stage 2025 |

| Bivamelagon | Rare obesity oral | Phase III soon |

| HRS9531 | Injectable dual | Global Phase III planned |

(MOA = Mechanism of action.)

Comprehensive view of the GLP‑1 and obesity-focused drug pipeline expected over the next three years (mid‑2025 to mid‑2028):

1. Dual & Triple Agonists (Injectable)

Retatrutide (Eli Lilly): GLP‑1/GIP/glucagon triple agonist. Phase 2 showed ~24% weight loss at high dose over 48 weeks (Yahoo Finance, Wikipedia). Phase 3 expected in 2026–2027.

CagriSema (Novo Nordisk): Semaglutide + cagrilintide (amylin analog). Phase III “REDEFINE” showed 20–22% weight loss at 68 weeks. Likely FDA filing in 2026 (Pharmaceutical Strategies Group (PSG)).

Mazdutide (Eli Lilly; IBI‑362): Dual GLP‑1/glucagon agonist, approved in China as of June 2025; global Phase III data are anticipated in 2026 (IQVIA).

Survodutide (Boehringer Ingelheim / Zealand Pharma): GLP‑1/glucagon dual agonist in Phase III, targeting obesity and MASH in 2027 (Prime Therapeutics).

Efocipegtrutide (HM15211): GLP‑1/GIP/glucagon triple agonist in Phase II–III for obesity/NASH (Wikipedia).

2. Oral GLP‑1 Agonists

Orforglipron (Eli Lilly): Small-molecule GLP‑1 RA taken once daily; Phase 3 data show ~8% weight loss (16 lbs); FDA filing planned late 2025 with U.S. launch in 2026 (Verywell Health).

Oral semaglutide (Wegovy 25 mg tablet): Submitted to FDA; approval expected Q4 2025 for weight loss and CV risk reduction (Prime Therapeutics).

Aleniglipron (GSBR‑1290): Oral small-molecule GLP‑1 agonist by Structure Therapeutics in Phase II; positive Phase 2a data (GoodRx).

AZD5004 (AstraZeneca): Oral GLP‑1 RA in mid‑stage trials; initial four-week diabetes study showed ~5.8% weight loss (Barron’s).

3. Emerging & Combo Agents

VK2735 (Viking Therapeutics): Dual GLP‑1/GIP, both injectable and oral versions; entering late-stage trials mid-2025 (Barron’s).

MariTide (Amgen): Monthly injectable; Phase II data ~20% weight loss; Phase III underway (Barron’s).

Petrelintide (Zealand Pharma): Amylin analog—potential combo with CT‑388; Phase 1b shows 8.6% weight loss over 16 weeks; partnered with Roche (delveinsight.com).

ACC‑G2671 (Structure Therapeutics): Amylin receptor agonist; Phase I/II due by late 2025 (Barron’s).

4. Rare-Obesity Indications

Bivamelagon (Rhythm Pharma): Oral MC4R agonist for hypothalamic obesity; Phase II showed BMI drops of 7–9%; Phase III planned (Investors).

HRS9531 (Hengrui / Kailera): GLP‑1/GIP agonist; Phase III showed ~18–19% weight loss; aiming for global trials (Barron’s).

🔍 Rising Trends

· Shift toward dual/triple agonists targeting multiple gut hormones for stronger weight loss (~20–25%).

· Oral GLP‑1 agents (e.g., orforglipron, oral semaglutide, aleniglipron) aim to improve accessibility/adherence.

· New amylin analogs and monthly injectables, along with rare-disease agents like MC4R agonists (bivamelagon) are in development (Verywell Health, Wikipedia, Barron’s, Investors, Pharmaceutical Strategies Group (PSG), delveinsight.com).

· A diversified landscape beyond Lilly & Novo—with entrants like Amgen, AZ, Roche, Structure, Viking, Rhythm, and Chinese biotechs (Barron’s).

📌 Conclusion

By mid‑2028, we’ll likely see multiple new formulations:

· Injectable dual/triple agonists (retatrutide, cagrisema, mazdutide, survodutide).

· Oral GLP‑1s (orforglipron, Wegovy tablet, aleniglipron, AZD5004, VK2735).

· Novel amylin analogs and monthly injectables.

· Agents targeting rare obesity syndromes (bivamelagon).

This pipeline could substantially reshape obesity treatment—delivering stronger efficacy, variant dosing options, and broader access.

Audio Overview (Google NotebookLM)

(14 minutes 22 seconds)